Accept all the popular payment methods, including Visa, Mastercard, EFTPOS Debit, American Express and more. Enjoy simple, speedy, contactless payments from cards, phones and wearable devices, including Apple Pay, Google Pay and Samsung Pay.

Experience around-the-clock local phone support, 365 days a year. Looking for quick troubleshooting tips? Visit our online Help Centre, otherwise call us on 1800 433 876 to connect with an Aussie or Kiwi EFTPOS specialist.

The average Smartpay merchant is saving $6,800* per year on transaction fees. By having your customers pay a small surcharge, you could be saving thousands of dollars every year.

Keep more of your hard-earned money in your pocket, or re-invest into your business. What will you do with your EFTPOS savings?

No EFTPOS bill or direct debit

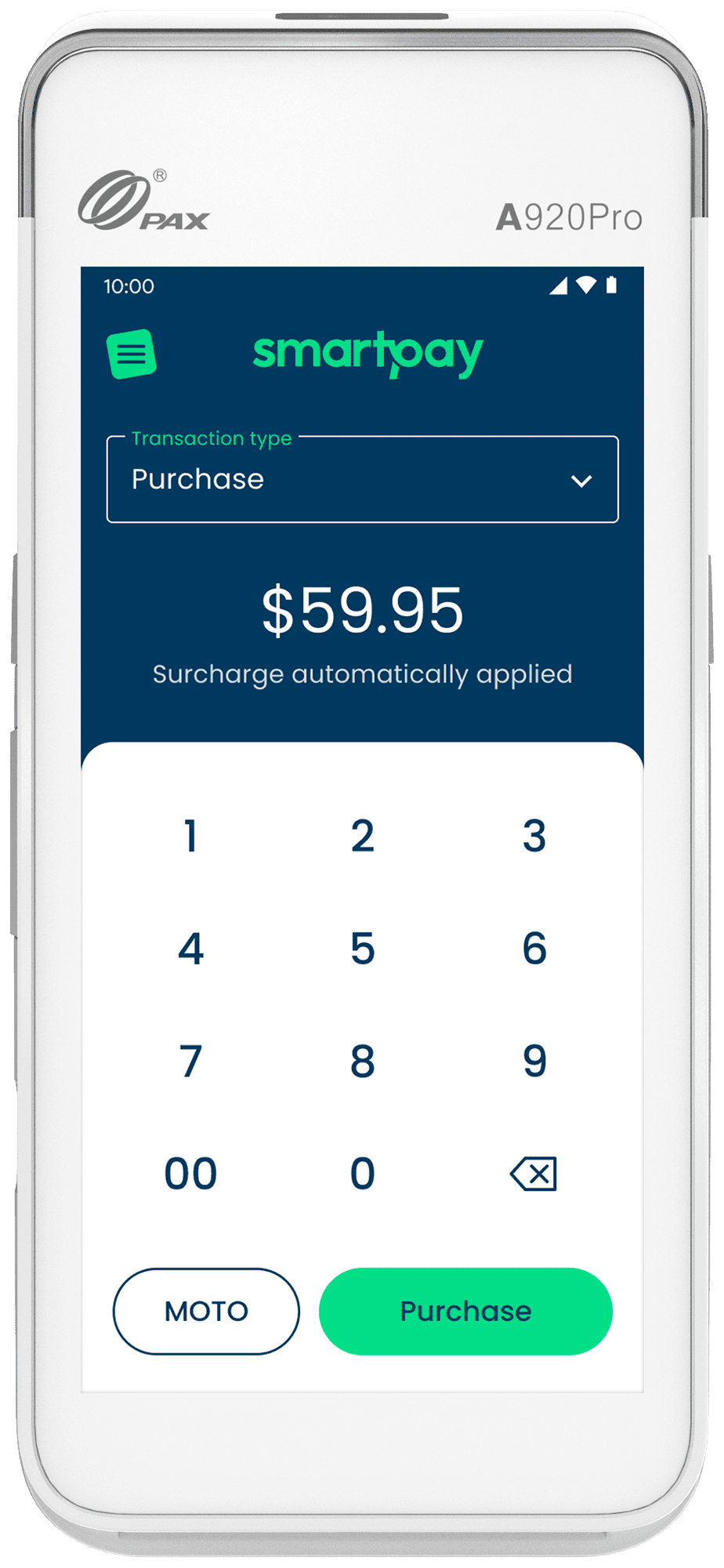

Automated surcharging - no guesswork required!

No terminal rental if you transact more than $10,000 per month

No lock-in contracts

EFTPOS, standing for Electronic Funds Transfer at Point of Sale, is a type of payment that can be processed at any card terminal that accepts card payments – whether from a card, phone, watch or wearable device. EFTPOS transactions have become the new norm, and is the most common way customers choose to pay in Australia.

We work with thousands of businesses across Australia and New Zealand, across hundreds of industries. From bars to butchers and businesses in between, chances are we service your industry.

Give us a call on 1800 574 999 to see if we can work together.

EFTPOS machines have been for a long time considered essential for businesses. Accelerated further by the increase of card usage throughout the COVID-19 pandemic, more customers than ever are choosing to pay by contactless payments - facilitated by an EFTPOS machine.

Customers now expect the ability to make card transactions when purchasing goods or services at small businesses - and we’re here to help you process them!

Smartpay terminals are simple to use. Once you complete a quick application with a Payment Specialist, we’ll send your new EFTPOS terminal to your business. You'll also receive a Getting Started guide, but if you have any questions during set-up you can call our 24/7 support number.

After you get your EFTPOS machine, simply switch it on and start taking payments! Accept all the popular payment types, in all the popular ways.

A team of Payment Specialists are on-hand to help you make the switch to Smartpay - and can often have you up and running in less than a week!

Our merchants receive 24/7 customer support, 365 days a year from Aussie and Kiwi EFTPOS specialists. Need help at 3AM during late-night trade? We can help. Not happy with your EFTPOS machines? With no lock-in contracts, cancel anytime.

You don’t need Wi-Fi to use Smartpay. Every Smartpay EFTPOS customer receives a free built-in 4G SIM card with their payment terminal, providing you with a reliable connection. You can also connect your terminal to a mobile hotspot if needed.

Buying an EFTPOS terminal outright is a way to make business owners feel obliged to stay with a provider. That's why at Smartpay, we lease our EFTPOS machines to our customers - with no monthly rental fee if you transact more than $10,000 per month with our Smartpay Zero Cost™ EFTPOS plan.

Alongside this, technology regularly changes, so your latest and greatest terminal could very quickly become outdated and require an upgrade, leaving you out of pocket. All of our software updates are completed remotely, meaning you don't need to do anything on your end to have the latest security features on your terminal.

Your card transactions are settled into your business bank account next business day. This means we settle Monday, Tuesday, Wednesday and Thursday transactions the next day, and Friday, Saturday and Sunday transactions on Monday. The funds are available to you depending on your bank’s processing.

Our customers have found that their customers are accepting of a minimal surcharge. Surcharges are now common in many industries such as bars, cafes, restaurants, automotive services and professional services, and help businesses cover rising transaction costs.

We provide clear countertop signage with each terminal to ensure you clearly communicate the surcharge amounts to your customers before they pay. The terminal also clearly indicates a surcharge, before a customer pays.

You can choose to pay the surcharge for your customer on a particular transaction by bypassing this on the terminal. If you choose to bypass the surcharge we’ll subtract the surcharge amount from your settlement for that day’s trading so there is still no bill to pay at the end of the month. We will however send you an invoice for any surcharges paid by you.

Alternatively, you can suggest the customer pays by debit (which is a lower cost) or cash (no surcharge).

You can choose when setting up Smartpay Zero Cost™ EFTPOS to always pay the Debit/EFTPOS cost yourself instead of passing on to the customer. This way, your customers can still pay by card, but only pay a surcharge for using a Visa or Mastercard (debit or credit).

For credit and debit card transactions and payments you can pay the charge yourself but you choose to do this on an individual transaction level.

No, you don’t need to worry about that! Smartpay Zero Cost™ EFTPOS is hassle-free with no admin on your part, and we ensure that your surcharge covers your cost of acceptance and is compliant with RBA surcharging standards.

Find out in less than a minute